Dalaguete, a charming municipality located in the southern part of Cebu, Philippines, is known for its stunning landscapes, rich culture, and vibrant community. As the local real estate market continues to grow, understanding the tax implications of buying, selling, or owning property in Dalaguete becomes essential for both investors and homeowners. This article provides an in-depth overview of the real estate tax rate in Dalaguete, including its structure, calculation, implications, and strategies for property owners.dalaguete real estate tax rate

Overview of Dalaguete’s Real Estate Market

Before diving into the specifics of real estate tax rates, it is essential to understand the broader context of the Dalaguete real estate market. Over the past few years, Dalaguete has witnessed a surge in interest from local and foreign investors. Factors contributing to this growth include:

- Natural Beauty: Known as the “Vegetable Basket of Cebu,” Dalaguete boasts breathtaking views of mountains and beaches, attracting individuals seeking both residential and commercial properties.

- Cultural Significance: The municipality has a rich cultural heritage, with various festivals and events that draw visitors throughout the year.

- Accessibility: With ongoing infrastructure developments, Dalaguete has become increasingly accessible, making it an attractive location for those looking to invest in real estate.

- Economic Growth: The local economy has shown signs of growth, leading to increased demand for housing and commercial spaces.

As the real estate market expands, understanding the associated tax rates and regulations becomes crucial for property owners and investors.

Understanding Real Estate Taxes in Dalaguete

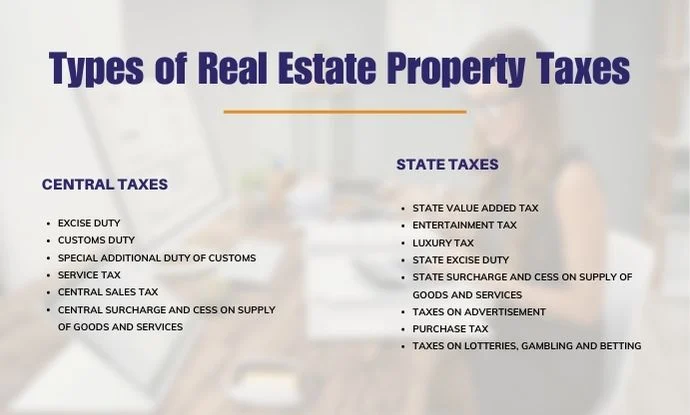

In the Philippines, real estate taxes are primarily governed by the National Internal Revenue Code (NIRC) and local government regulations. In Dalaguete, property taxes consist of several components, including:

- Real Property Tax (RPT): This is the main tax levied on real estate properties, calculated based on the assessed value of the property.

- Transfer Tax: A tax imposed on the transfer of ownership of a property, usually paid during the sale or transfer of real estate.

- Capital Gains Tax (CGT): This tax is applied to the profit made from selling a property, which can significantly impact real estate transactions.

- Documentary Stamp Tax (DST): This tax applies to certain documents involved in real estate transactions, such as contracts of sale and deeds of transfer.

Real Property Tax (RPT) in Dalaguete

The Real Property Tax (RPT) is a significant source of revenue for local government units (LGUs) in the Philippines, including Dalaguete. The tax rate for RPT is typically set by the local government in accordance with the guidelines established by the Department of Finance.

- Tax Rate: In Dalaguete, the general real property tax rate is 1% for residential properties and 2% for commercial properties, based on their assessed value. However, these rates may vary based on local ordinances.

- Assessment Levels: The assessed value of a property is determined using the following formula:Assessed Value=Market Value×Assessment Level\text{Assessed Value} = \text{Market Value} \times \text{Assessment Level}Assessed Value=Market Value×Assessment LevelThe assessment level varies based on the type of property. For example, residential properties usually have a lower assessment level compared to commercial properties.

- Market Value: The market value is the fair market price of the property as determined by the local assessor’s office. It is important to note that the market value may be different from the purchase price, especially in a rapidly growing market like Dalaguete.

Calculation of Real Property Tax

To calculate the Real Property Tax owed, property owners can follow these steps:

- Determine the Market Value: Obtain the market value of the property from the local assessor’s office or through a property appraisal.

- Apply the Assessment Level: Multiply the market value by the applicable assessment level for the type of property.

- Calculate the RPT: Multiply the assessed value by the corresponding tax rate (1% for residential and 2% for commercial properties).

Example Calculation

Suppose a residential property in Dalaguete has a market value of PHP 1,000,000. The assessment level for residential properties is 20%. The calculation would be as follows:

- Assessed Value:Assessed Value=1,000,000×0.20=200,000\text{Assessed Value} = 1,000,000 \times 0.20 = 200,000Assessed Value=1,000,000×0.20=200,000

- Real Property Tax:RPT=200,000×0.01=2,000\text{RPT} = 200,000 \times 0.01 = 2,000RPT=200,000×0.01=2,000

Thus, the property owner would owe PHP 2,000 in Real Property Tax for that year.

Transfer Tax and Its Implications

The transfer tax is another critical consideration for real estate transactions in Dalaguete. When a property is sold or transferred, the seller is required to pay a transfer tax based on the selling price or the fair market value of the property, whichever is higher.

Transfer Tax Rate

The transfer tax rate in Dalaguete is generally 0.5% of the selling price or fair market value. This tax is typically paid at the time of the transfer of ownership, and failure to pay it can result in penalties and delays in the registration of the property.

Capital Gains Tax (CGT)

When selling a property in Dalaguete, sellers must also consider the Capital Gains Tax (CGT). The CGT is imposed on the net gain from the sale of real property and is set at a rate of 6% of the selling price or the fair market value, whichever is higher.

Documentary Stamp Tax (DST)

The Documentary Stamp Tax (DST) is applicable to certain documents involved in real estate transactions. The rate for the DST is PHP 15 for every PHP 1,000 of the selling price or the fair market value of the property.

Implications of Real Estate Taxes

Understanding the tax structure in Dalaguete is crucial for property owners and investors. Here are some implications of real estate taxes:

- Budgeting: Property owners should factor in these taxes when budgeting for homeownership or investment properties to avoid any financial strain.

- Investment Decisions: Investors should consider the tax implications when purchasing properties, as these can affect overall profitability.

- Compliance: Failure to comply with local tax regulations can result in penalties, legal issues, or loss of property.

- Future Value: Understanding tax implications can also inform property value assessments, which are crucial for future sales or investments.

Strategies for Managing Real Estate Taxes

Property owners in Dalaguete can employ several strategies to manage their real estate tax liabilities effectively:

- Stay Informed: Keeping abreast of local tax regulations and changes in rates is essential for effective tax management.

- Consult Professionals: Engaging a tax consultant or real estate professional can provide valuable insights into tax obligations and potential savings.

- Proper Valuation: Ensuring that properties are correctly assessed can help avoid overpayment of taxes. Regularly reviewing the market value and the assessed value of properties is recommended.

- Utilize Tax Incentives: Property owners should explore any available tax incentives or exemptions that may reduce their tax liabilities.

- Plan Transactions Carefully: Timing property sales or transfers strategically can help mitigate tax impacts. For example, waiting for a more favorable tax environment could lead to significant savings.

Conclusion

As Dalaguete continues to grow as a prime real estate destination, understanding the local real estate tax rate and its implications is vital for both homeowners and investors. By grasping the components of the real property tax system, staying informed about changes in regulations, and employing effective tax management strategies, property owners can navigate the Dalaguete real estate landscape with confidence.

Whether you’re a first-time homebuyer, an investor, or a long-term resident, being informed about real estate taxes can significantly impact your financial decisions. With careful planning and knowledge, you can maximize your investments while fulfilling your tax obligations in Dalaguete.